Relative stability as Bowen moves towards more typical market activity

Bowen moved to a balanced market with typically slow summer activity during July and August. There have been just 3 sales to date in August, down from the 10-year average of 5. For the month of July, there were 4 detached home sales.

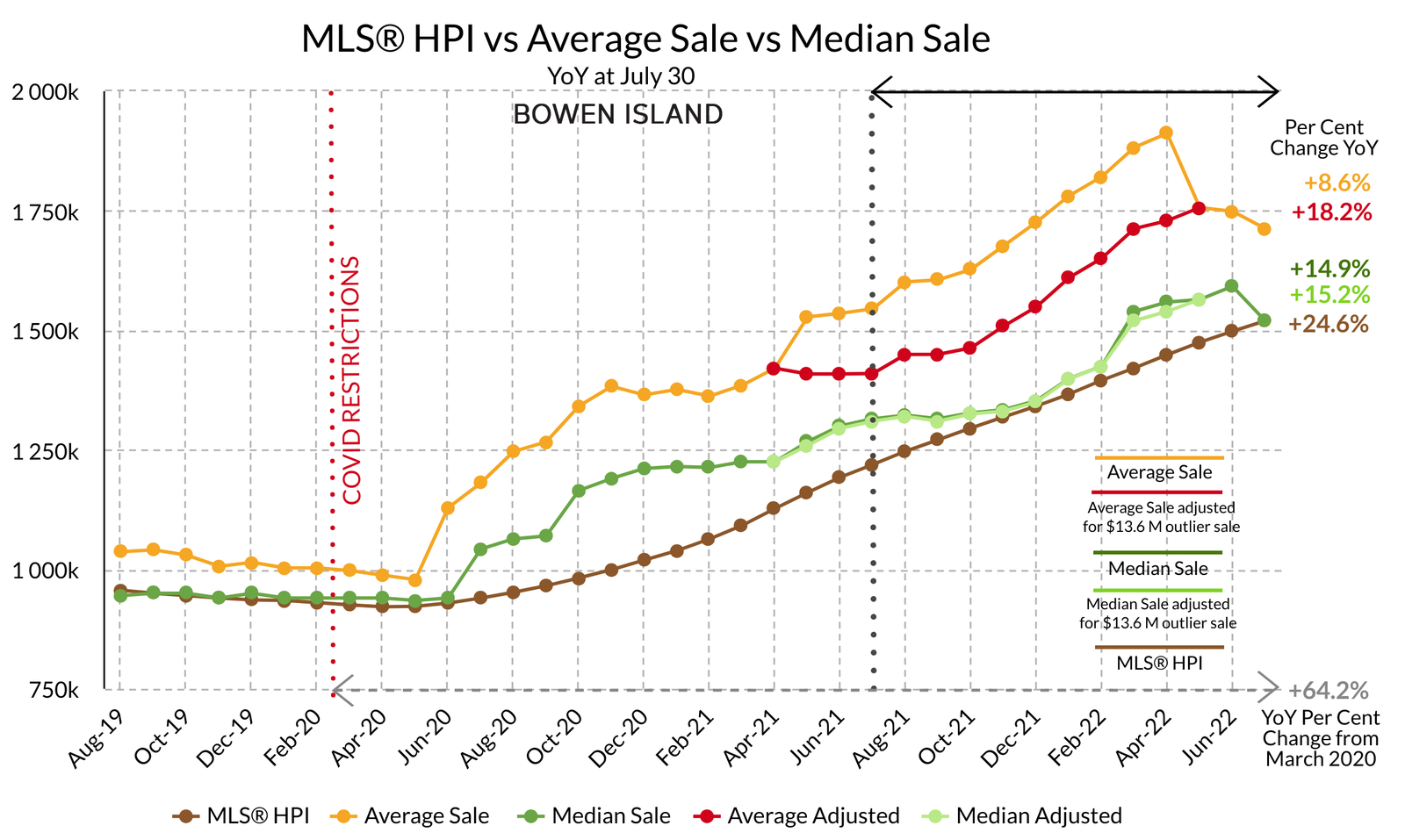

At the end of July, the YoY average and median sale price were down from June 2.0 per cent and 4.5 per cent respectively while the MLS® Home Price Index or benchmark price reached a new high, up 1.5 per cent from June. YoY the rate has risen an average of 2.5 per cent per month since May 2020.

The sales-to-active ratio is the number of home sales divided by total active inventory for the specified period. A balanced market is considered to be between 12 and 20 per cent. Bowen’s sales-to-active ratio was 16.7 per cent for the month of July. The 10-year average for July is 12.8.

Metro Vancouver’s sales-to-active ratio has been trending down since March 2022 to 11.8 per cent for the month of July as Metro begins to enter a buyer’s market.

The YoY MLS® HPI or benchmark price for Bowen Island in July was a record high of $1,519,942, a 24.6 per cent increase over July 2021 and a 1.5 per cent increase compared to June 2022. The price for the month of July was $1,619,100, up 19.5 per cent from July 2021 and a 3.3 per cent decrease from the record monthly high of $1,674,100 in May 2022.

YoY number of detached home sales in July 2022 reached 66, a 26.7 per cent decrease from the 95 detached sales recorded in July 2021.

YoY Average Sale Price in July 2022 was down slightly at $1,707,889, a decrease of 2.4 per cent from July 2021 and the third consecutive month of decline.

YoY Median Sale Price for July registered the first decline since May 2020, ending at $1,520,000, a decrease of 4.5 per cent from July 2021.

For the month of July, the Total Inventory for sale was 35. The 10-year average for July is 54 and the 10-year median is 40. There were 17 New Listings, greater than the 10-year average of 11 for July and the 10-year median of 10.

There were 4 detached home sales in the month of July. The 10-year average for July is 6 and the 10-year median is 5.

The market will be slower moving forward, and September is anticipated to see the Bank of Canada rate raised by at least another 0. 5-0.75 per cent. Mortgage and real estate pundits project that the BoC rate will top at 3.25-3.5 per cent in 2023 and then begin to drop back closer to 2% by the end of 2023 or in 2024.

Where are prices going? Predictions from real estate companies, mortgage companies, and financial institutions range from benchmark price declines by as much as 14 per cent to relatively flat prices through the second half of 2022 to price increases by the end of 2023.

In other words, no one really knows, especially in markets like Metro Vancouver where “interest-rate hikes have edged up carrying costs, [and] the effect of the tight rental market, which has seen average rents increase by double-digits year-over-year in the [Greater Vancouver Area] and [Greater Toronto Area]. As potential buyers face those realities, many will still conclude that the benefits of ownership make better financial sense.”*

* https://blog.remax.ca/hottest-areas-in-greater-vancouver-greater-toronto-housing-market/

Currently, although there is downward pressure, Bowen appears to be experiencing relative stability as it moves towards a balanced market.

At the end of July, the YoY average and median sale price were down from June 2.0 per cent and 4.5 per cent respectively while the MLS® Home Price Index or benchmark price reached a new high, up 1.5 per cent from June. YoY the rate has risen an average of 2.5 per cent per month since May 2020.

The sales-to-active ratio is the number of home sales divided by total active inventory for the specified period. A balanced market is considered to be between 12 and 20 per cent. Bowen’s sales-to-active ratio was 16.7 per cent for the month of July. The 10-year average for July is 12.8.

Metro Vancouver’s sales-to-active ratio has been trending down since March 2022 to 11.8 per cent for the month of July as Metro begins to enter a buyer’s market.

The YoY MLS® HPI or benchmark price for Bowen Island in July was a record high of $1,519,942, a 24.6 per cent increase over July 2021 and a 1.5 per cent increase compared to June 2022. The price for the month of July was $1,619,100, up 19.5 per cent from July 2021 and a 3.3 per cent decrease from the record monthly high of $1,674,100 in May 2022.

YoY number of detached home sales in July 2022 reached 66, a 26.7 per cent decrease from the 95 detached sales recorded in July 2021.

YoY Average Sale Price in July 2022 was down slightly at $1,707,889, a decrease of 2.4 per cent from July 2021 and the third consecutive month of decline.

YoY Median Sale Price for July registered the first decline since May 2020, ending at $1,520,000, a decrease of 4.5 per cent from July 2021.

For the month of July, the Total Inventory for sale was 35. The 10-year average for July is 54 and the 10-year median is 40. There were 17 New Listings, greater than the 10-year average of 11 for July and the 10-year median of 10.

There were 4 detached home sales in the month of July. The 10-year average for July is 6 and the 10-year median is 5.

The market will be slower moving forward, and September is anticipated to see the Bank of Canada rate raised by at least another 0. 5-0.75 per cent. Mortgage and real estate pundits project that the BoC rate will top at 3.25-3.5 per cent in 2023 and then begin to drop back closer to 2% by the end of 2023 or in 2024.

Where are prices going? Predictions from real estate companies, mortgage companies, and financial institutions range from benchmark price declines by as much as 14 per cent to relatively flat prices through the second half of 2022 to price increases by the end of 2023.

In other words, no one really knows, especially in markets like Metro Vancouver where “interest-rate hikes have edged up carrying costs, [and] the effect of the tight rental market, which has seen average rents increase by double-digits year-over-year in the [Greater Vancouver Area] and [Greater Toronto Area]. As potential buyers face those realities, many will still conclude that the benefits of ownership make better financial sense.”*

* https://blog.remax.ca/hottest-areas-in-greater-vancouver-greater-toronto-housing-market/

Currently, although there is downward pressure, Bowen appears to be experiencing relative stability as it moves towards a balanced market.

Month of JULY Detached Homes

SALE PRICE vs LIST PRICE

• YoY INDICATORS

• Low $490,000 $499,000

• High $1,385,000 $1,385,000

• Average Sale: $885.833

• Median Sale: $860,000

• High $1,385,000 $1,385,000

• Average Sale: $885.833

• Median Sale: $860,000

• YoY INDICATORS

• MLS®HPI: $1,519,942

• Average Price: $1,701,889

• Median Price: $1,520,000

• Average Price: $1,701,889

• Median Price: $1,520,000

YoY Lots Average Sale Price Range

$6.65–44.44 per sq. ft.

STATS ON BOWEN is a detailed analysis published monthly once all data for the month has been reported.

Published during the month following.

If you would like early access to the report during the first week of the month,

WE DO NOT SPAM.

You will only receive email related to the STATS ON BOWEN monthly reports and the occasional update.